My dear hubby thinks I am nuts, lol. No, not certifiably nuts; but he cannot understand my need to establish savings envelopes for different purposes. He is an accountant and I guess he is just more adept at looking at a total monetary value and figuring in his head how much is available for each spending category. Not me. I need to see it broken down by uses and I need to see each individual category growing! It is the ONLY thing that keeps me motivated! So tell me....am I really as nuts as he says, lol? I think not...especially if it works! And IT DOES!

HERE'S HOW.........

At the present time I have seven separate savings categories....some necessary and some just plain FUN (my FAVORITE kind, lol).

HOBBY MONEY:

Probably close to a year ago now (if not more...I'm really bad at judging time) our local Bottom Dollar was giving away little orange piggy banks. I put one in my desk and have begun placing quarters and dimes into the pig...in one dollar increments. I have a post-it note on the outside of the pig that states how much money I have saved in quarters and in dimes. This is my "hobby" money. When I finally hit a total of $200 I will allow myself to spend up to $100 on my favorite hobbies. The $100 that remains in the bank will be a hidden "emergency fund" to help us out in case of a crisis. My piggy bank is mostly funded by change from purchases, "found money" (you would be amazed how many coins you can find on the ground), money found lying on the floor in our house, or in the sofa cushions, or the washer or dryer, or coat pockets, or the floor of the car, etc.

Probably close to a year ago now (if not more...I'm really bad at judging time) our local Bottom Dollar was giving away little orange piggy banks. I put one in my desk and have begun placing quarters and dimes into the pig...in one dollar increments. I have a post-it note on the outside of the pig that states how much money I have saved in quarters and in dimes. This is my "hobby" money. When I finally hit a total of $200 I will allow myself to spend up to $100 on my favorite hobbies. The $100 that remains in the bank will be a hidden "emergency fund" to help us out in case of a crisis. My piggy bank is mostly funded by change from purchases, "found money" (you would be amazed how many coins you can find on the ground), money found lying on the floor in our house, or in the sofa cushions, or the washer or dryer, or coat pockets, or the floor of the car, etc.

In fact, last evening I hit the mother-load of coins...found in the bottom of a purse that I have not used in over a year! I was cleaning out one small shelf in my closet, looking for donations for Purple Heart, when I lifted a purse and it felt "heavy". I stuck my hand inside to find the entire bottom filled with coins. I quickly dumped them out, sorted and counted them to find $11 in quarters, $2 in dimes, a handful of nickels and two handfuls of pennies! SCORE! So with my little discovery I was able to further fund my hobby piggy, plus two other change stashes. It was a GREAT night!

FUN MONEY:

For my birthday last year my best friend sent me a beautiful imported pottery money jar. The accompanying little card says one is supposed to fill the money jar and then break it open, spend the money on something fun, and it will bring good luck. What? Break this beautiful jar??!!! The online explanation from the company says that it is possible to just break the very top off to get to the money (if not, I am sure they would be MORE than happy to sell me a replacement, lol). So I have begun filling the jar with all of my nickels. At this point in time I have absolutely NO idea what I will spend the money on, nor do I know for sure that I will actually break open this beautiful piece of hand crafted pottery! It may end up being a several hundred dollar stash of coins that remains intact unless we suffer a major catastrophe.

VACATION MONEY:

VACATION MONEY:

Years ago my hubby brought a 5 gallon water bottle home from work. For years this was our major coin depository. We have, in the past, used the money to pay an unexpected bill...but our main goal lately has been to fund our vacations every year. Every night my hubby empties his pockets into the jar, while I feed it my pennies. After all, I have several other coin stashes to fund, lol!!

CHRISTMAS MONEY:

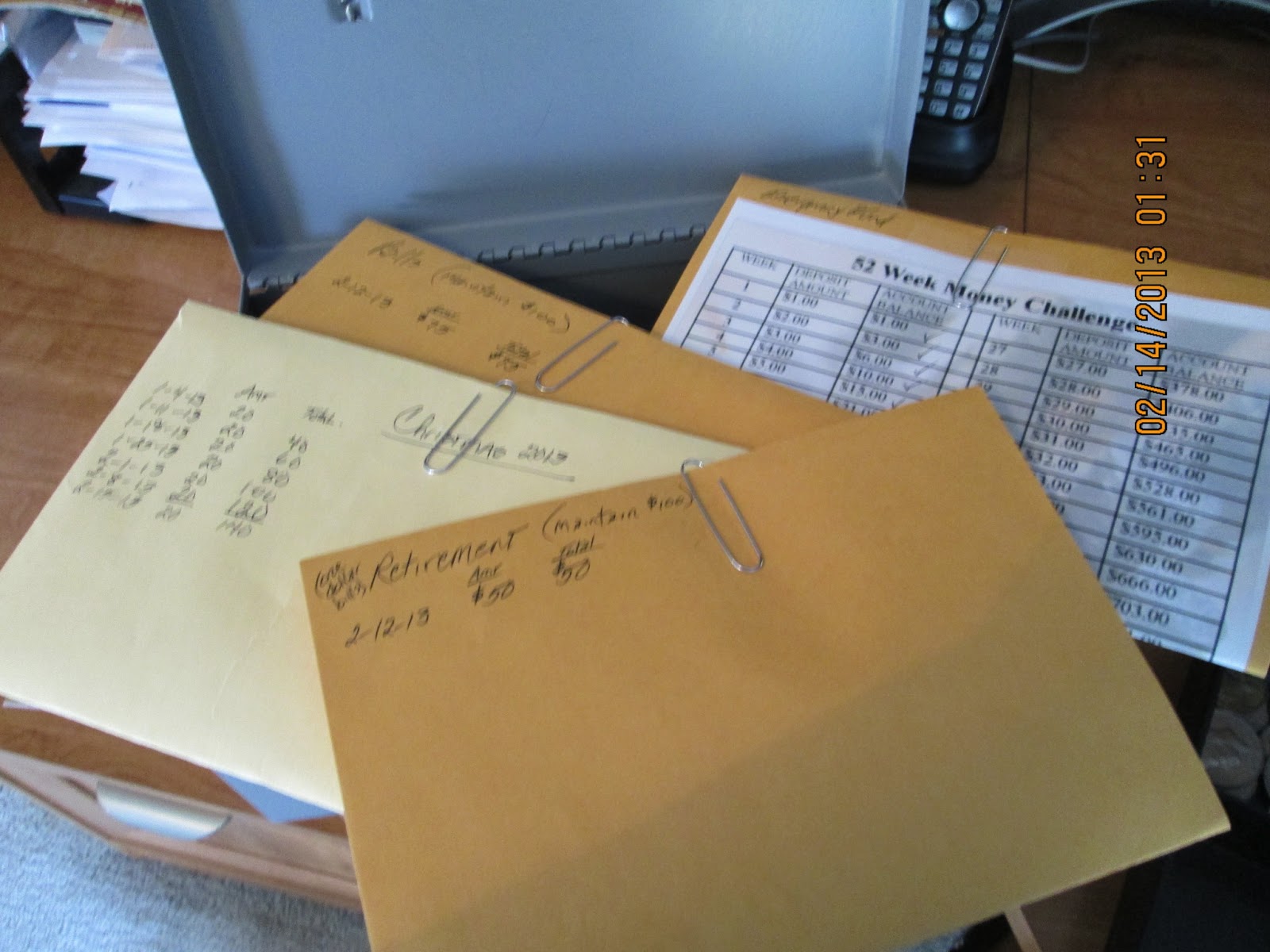

Years ago we established formal Christmas Funds with our local bank. As we have now switched to a credit union for all of our banking, I don't have easy access to a Christmas Fund. So this year I have decided to follow along with some online friends and have established a Christmas Fund right here in my sewing room. I have a manilla envelope into which I place my weekly contribution. I then log the date, amount and running total on the front of the envelope. So far I have not yet missed a payment in 2013. Okay, okay...so I know it is only the middle of February, but I have fallen off the horse well before this date in the past, lol. A few years back I managed to fund my Christmas Club every single week up until Thanksgiving. Having that stash of cash REALLY helped lower the after Christmas bills and I am planning on January 2014 being even easier than before.

EMERGENCY FUND:

My friends on the Frugal Living Forum at About.com have started a 52 week challenge. The premise is to deposit into the fund the amount of cash corresponding to the week of the year. The first week of 2013 you would deposit $1. The second week of 2013 you would deposit $2, and so on and so on. As this Friday is the 7th of the year, I should have a total of $28 in my envelope. However, I recycled some aluminum cans and used part of the proceeds to fund through next Friday. WooHoo...I'm ahead of the game!!! Unfortunately, since my son has moved out I will no longer be able to handle taking the recycling to a local company for cash and will have to go back to putting my cans out with the rest of the recycling picked up by our trash hauler. At the end of the year I will deposit my 52 week money into an official "Emergency Fund".

BILLS:

I have a manilla envelope marked "Bills". Every Saturday I take whatever cash is left in my wallet (minus $1 bills, as I will explain later) and place the money in the envelope. Some weeks it may only be $5, other weeks I can put up to $20 in the envelope. It all depends on how much money I need to spend during the week. Then hubby and I will tap MAC and refill both of our wallets, based on the amount of money we assume we will need for the week. When this envelope reaches $200, I will put $100 additional payment on the bill with the highest interest rate. The $100 that remains in the envelope will be another source of hidden "emergency funds".

RETIREMENT:

Every Saturday those $1 bills in my wallet that I mentioned above are placed into an envelope marked "Retirement". Like my "Bills" envelope, when I reach $200, I will take $100 and deposit it into my retirement account. The remaining $100 will be yet a third source of hidden "emergency funds".

MISCELLANEOUS:

MISCELLANEOUS:

Throughout the year we receive reimbursements from our FSA account for medical expenses we pay out of pocket. I am hoping to be able to add that money to our Bill Fund, our Christmas Fund, our Retirement Fund, or our Emergency Fund...depending on which account needs the most "help" in staying current. We may also decide to place the money into a totally new fund...an Improvements Fund. As our house is now 23 years old we are reaching the "replacement" time for many of the larger items such as the roof, the siding, the carpet, etc. Almost two years ago we purchased a whole new heating and air conditioning system. It will be paid off in just a few short months. Hopefully this new HVAC system will last as long as we are still living in the house. I guess the decision as to where to put any "found money" or "reimbursement money" will be made based upon our needs at the time.

On that point we agree!

No comments:

Post a Comment